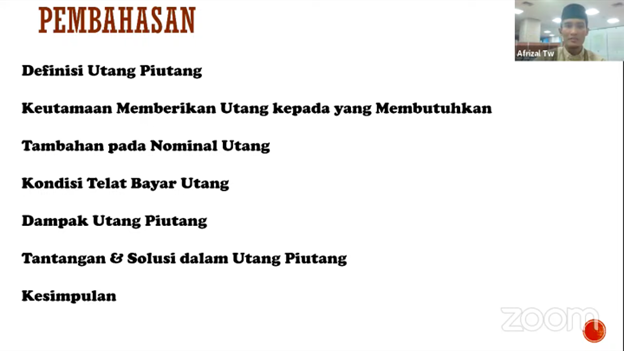

On June 28, 2024, Yarsi University held an webinar titled “Hutang Piutang dalam Islam: Dampak & Tantangannya,” which provided an in-depth exploration of debt and credit within the framework of Islamic finance. The webinar began by defining debt and credit according to Islamic principles. It emphasized the virtue of providing loans to those in need, underscoring it as an act of charity and community support. The discussion also addressed the addition of nominal amounts to loans and the implications of delayed payments, stressing the importance of compassion and understanding in these situations.

The webinar further examined the broader impacts of debt on individuals and society, including financial strain and social inequities. Challenges related to managing debt under Islamic principles were explored, such as the need for transparent and fair contracts and improved financial literacy. Solutions proposed included enhancing education on Islamic finance practices and developing mechanisms to ensure compliance with Islamic ethics. This event aligns with Sustainable Development Goals (SDGs) such as SDG 1: No Poverty, by promoting fair financial practices that support vulnerable populations, and SDG 10: Reduced Inequalities, by addressing financial challenges and advocating for equitable solutions. The seminar aimed to foster a deeper understanding of Islamic finance and offer practical strategies to manage debt in a manner consistent with Islamic values.